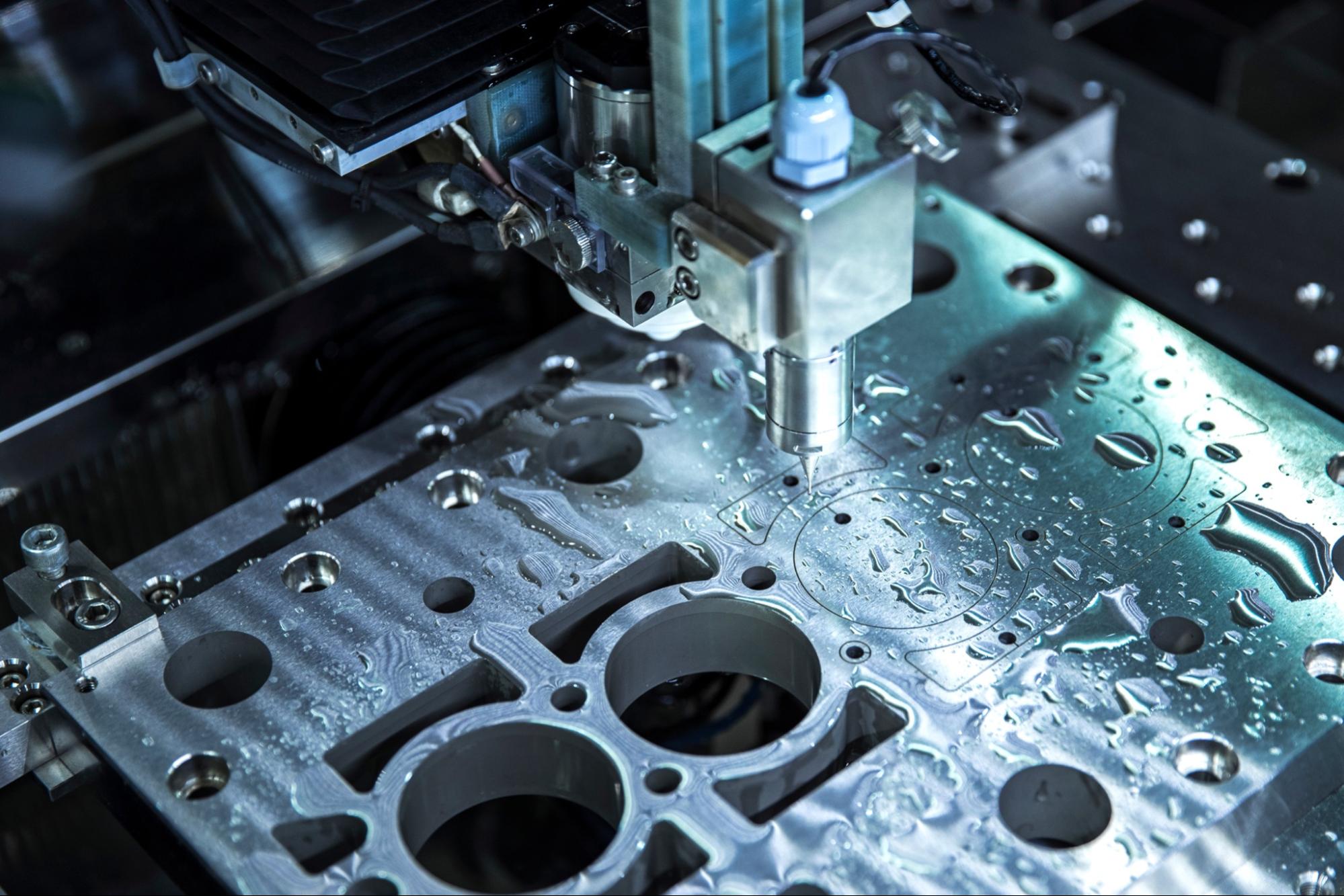

Metal CFDs have always been a popular financial derivative. Whether you are interested in investing in precious metals (such as gold and silver) or industrial metals (such as copper, iron, and steel), CFDs are a great way for traders to tap into these markets without having to physically own any of the products. This article will go through what metal CFD trading is, why people trade metal CFDs, and more importantly, the factors to consider when participating in trading.

What is metal CFD trading?

Metal CFD trading is simply the speculation of metals prices using a contract for difference, with the goal of making a profit. A trader decides they want to go long or short on a specific metal, and they purchase a contract for a certain amount of that metal. They then monitor the market for price changes. When they want to close their position to take profit (or to limit their losses), they purchase another contract of the same size that takes the opposite position.

Types of metals you can trade

When it comes to trading CFDs on metals, you as a trader have options. The most popular CFDs are by far gold and silver CFDs, due to their accessibility. However, there are also others who speculate on the market performance of industrial metals, such as iron, steel, copper, metal ores, and more.

Why trade metal CFDs?

Traders may participate in trading metal CFDs for a variety of reasons.

For example, they may want to participate in the metals markets, but they do not want to physically buy any metals because they are difficult to transport. Therefore, they may choose to use a CFD, through which they can speculate on market price changes and potentially make a profit without physically owning the metals.

Traders may also participate in metal CFD trading because of its convenience. CFDs are highly accessible and flexible. There are plenty of metals traders can speculate on through these contracts which have no expiry dates, so traders can keep their positions open both in the short and long term.

Thirdly, traders may utilise metal CFDs because of the ability to use leverage. Traders can gain greater exposure to the market with the same amount of capital at the outset, and they can potentially, substantially increase their profits.

Finally, traders can trade around the clock when they buy and sell CFDs. This means they can enter or exit the market at any time, which is a big advantage for traders who want to speculate on volatile markets.

Factors to consider when trading metal CFDs

Though there are unique factors traders must consider when trading specific instruments (such as gold, silver, iron, steel, and more), there are some ‘universal’ factors that market participants must consider:

If CFD trading is right for you

The first thing you should think about is whether CFD trading is right for you. Even though there are many benefits of CFD trading, from its high accessibility to its relative simplicity as a financial derivative, it may not be the most suitable for you. Think about your trading goals. Do you want to make substantial profits with the use of leverage? Do you want to own the underlying asset or simply speculate on its price movements?

The volatility of the chosen metal

The next thing you should consider is how volatile the market is for your chosen instrument. If you are looking to profit from rapid changes, you should choose a market that has more pronounced ups and downs like steel and iron, rather than a typical ‘stable’ market like gold.

Price patterns of the metal market

You should also know that some metals follow seasonal pricepatterns. For example, gold prices are relatively stable and show low volatility. However, this does not mean their prices stay the same throughout the months in the year.

For example, in the past 20 years, goldhas displayed a similar price pattern where their prices increase in the winter months and decrease in the summer months. This could be because more people purchase gold jewellery during the holiday season from late November to early February, from Christmas to the Lunar New Year.

How much leverage to use

Depending on the CFD provider you work with, you may need have limitations on how much leverage you can use. However, traders still must make a personal decision – whether they want to use leverage at all, and how much. Consider your budget, risk appetite, and the volatility of the market. Do not amplify your positions substantially if you cannot stomach the risk.

Contract specifications

You should certainly understand what a CFD contract comprises and how providers price them. On top of that, familiarise yourself with the key terms in CFD trading, such as the spread, the underlying asset, and margin efficiency.

Depending on the instrument on which you speculate, there may be different trading fee percentages and commission surcharges, and there may also be order minimums. Ensure you understand local regulations and provider requirements.

Trading fees and costs

You should also consider the broker you work with – particularly the trading fees and costs they charge to trade metal CFDs. When you purchase a CFD, you will find their quotations in two prices: the buy price and the sell price. They depend on the spreads quoted by a specific broker or provider, and they may vary from institution to institution. Some providers may also charge a commission for every contract you purchase.

Knowing your provider’s fee structure is crucial, as you do not want to end up having to pay for extra costs that can eat into your overall profits. You should therefore ensure there are no hidden charges for CFD trading as well.

The wider economy

Aside from analysing price patterns and volatility of metal markets, you should also consider conducting fundamental analysis to gain context. For every metal, there will be a country that is its major exporter and another one that is its major importer. Consider trade relationships between countries and international agreements and disagreements. This will have an impact on the supply and demand of a certain metal.

For example, China is the leading steel importer globally, as the country has huge involvement in manufacturing. The next biggest steel importers are the United States and Germany, both countries with sizeable manufacturing involvement as well. On the other hand, the world’s greatest exporters of steel are China and Russia, followed by Japan. If you are trading steel CFDs, it is crucial to stay up to date with the relationships and trade terms between these countries, as these factors directly influence the price of steel.

The bottom line

Trading metal CFDs is a great way to participate in the metals market without needing to physically own metals. CFDs are relatively simple to understand, and traders usually find little difficulty in learning the ropes when trading. There is a wide variety of metals to speculate on, each with different characters, price patterns, and volatility levels. In other words, there is something for everyone. However, traders should remember that all forms of trading carry risk, and no market or trading method can guarantee profits. Therefore, it is always advisable to trade with caution.